IMF slashes SA’s growth forecast as US tariffs wreak havoc in global trade

ECONOMY

The WEO also presented a global forecast under different policy assumptions excluding the April tariffs (pre-April 2 forecast). Under this alternative path, the IMF said global growth would have seen only a modest cumulative downgrade of 0.2 percentage point, to 3.2 percent for 2025 and 2026.

Image: Brendan Smialowski/AFP

The International Monetary Fund (IMF) has slashed South Africa’s economic growth projections for 2025 by 0.5 percentage on the back of slowing activity in the country’s two largest trading partners amid rising US tariffs.

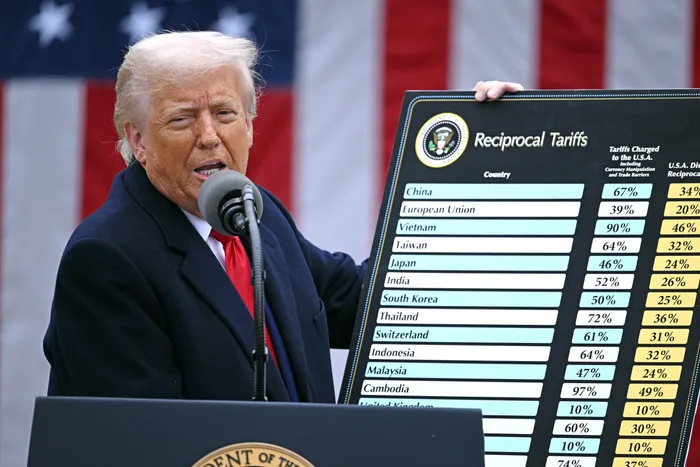

The US government announced sweeping reciprocal import tariffs on 60 countries earlier this month, sparking retaliation and raising trade barriers to levels not seen since the Great Depression.

In its World Economic Outlook (WEO) for April, the IMF on Tuesday projected South Africa’s real gross domestic product (GDP) to rise only to 1% in 2025 and 1.3% in 2026, which will also drag down the Sub-Saharan African economy.

Though this projection is an increase from 0.6% in 2024 and 0.7% in 2023, it is a significant downward revision in GDP prospects after the IMF in January forecast 1.5% and 1.6% growth in South Africa’s economy this year.

‘For Sub-Saharan Africa, growth is expected to decline slightly from 4% in 2024 to 3.8% in 2025 and recover modestly in 2026, lifting to 4.2%,” noted the WEO report.

“Among the larger economies, the growth forecast in South Africa is revised down by 0.5 percentage points for 2025 and 0.3 percentage points for 2026, reflecting slowing momentum from a weaker-than-expected 2024 outturn, deteriorating sentiment due to heightened uncertainty, the intensification of protectionist policies, and a deeper slowdown in major economies.”

The IMF warned that risks to the global economy have increased, and worsening trade tensions could further depress growth.

It said financial conditions could tighten further as markets react negatively to the diminished growth prospects and increased uncertainty. While banks remain well capitalized overall, financial markets may face more severe tests.

The WOE’s reference forecast includes tariff announcements between February 1 and April 4 by the US and countermeasures by other countries.

IMF chief economist Pierre-Olivier Gourinchas said this reduces their global growth forecast to 2.8% and 3% this year and next, a cumulative downgrade of about 0.8 percentage point relative to the January 2025 WEO update.

“The landscape has changed since our last World Economic Outlook update in January. We're entering a new era as the global economic system that has operated for the last 80 years is being reset,” Gourinchas said.

“The US effective tariff rate has surged past levelS reached more than a hundred years ago, while tariff rates in the US have also increased.

“Beyond the abrupt increase in tariffs, the surge in policy uncertainty is a major driver of the economic outlook. If sustained, the increase in trade tensions and uncertainty will slow global growth significantly.”

The WEO also presented a global forecast under different policy assumptions excluding the April tariffs (pre-April 2 forecast).

Under this alternative path, the IMF said global growth would have seen only a modest cumulative downgrade of 0.2 percentage point, to 3.2 percent for 2025 and 2026.

The IMF warned that risks to the global economy have increased, and worsening trade tensions could further depress growth.

Image: Supplied

Gourinchas, however, said growth prospects could immediately improve if countries ease their current trade policy stance and forge new trade agreements.

“For the United States, the tariffs represent a supply shock that reduces productivity and output permanently and increases price pressures temporarily. This adds to an already weakening outlook and leads us to revise growth down by 0.9 percentage point to 1.8%, with a 0.4 percentage point downgrade from the tariffs only, while inflation is revised upwards,” Gourinchas said.

“For trading partners, tariffs act mostly as a negative external demand shock, weakening activity and prices, even if some countries could benefit from trade diversion. This is why we have lowered our China growth forecast this year to 4%, while inflation is revised down by 0.8 percentage point, increasing deflationary pressures.

“All countries are negatively affected by the surge in trade policy uncertainty, as businesses cut purchases and investment, while financial institutions reassess their borrowers' exposure. Uncertainty also increases because of the complex sectoral disruptions that tariffs could cause up and down supply chains, as we saw during the pandemic.”

BUSINESS REPORT