ManpowerGroup finds that SA employers reluctant to hire in last quarter of 2019

Lyndy van den Barselaar, MD of Manpower SA. Photo: Supplied. Lyndy van den Barselaar, MD of Manpower SA. Photo: Supplied.

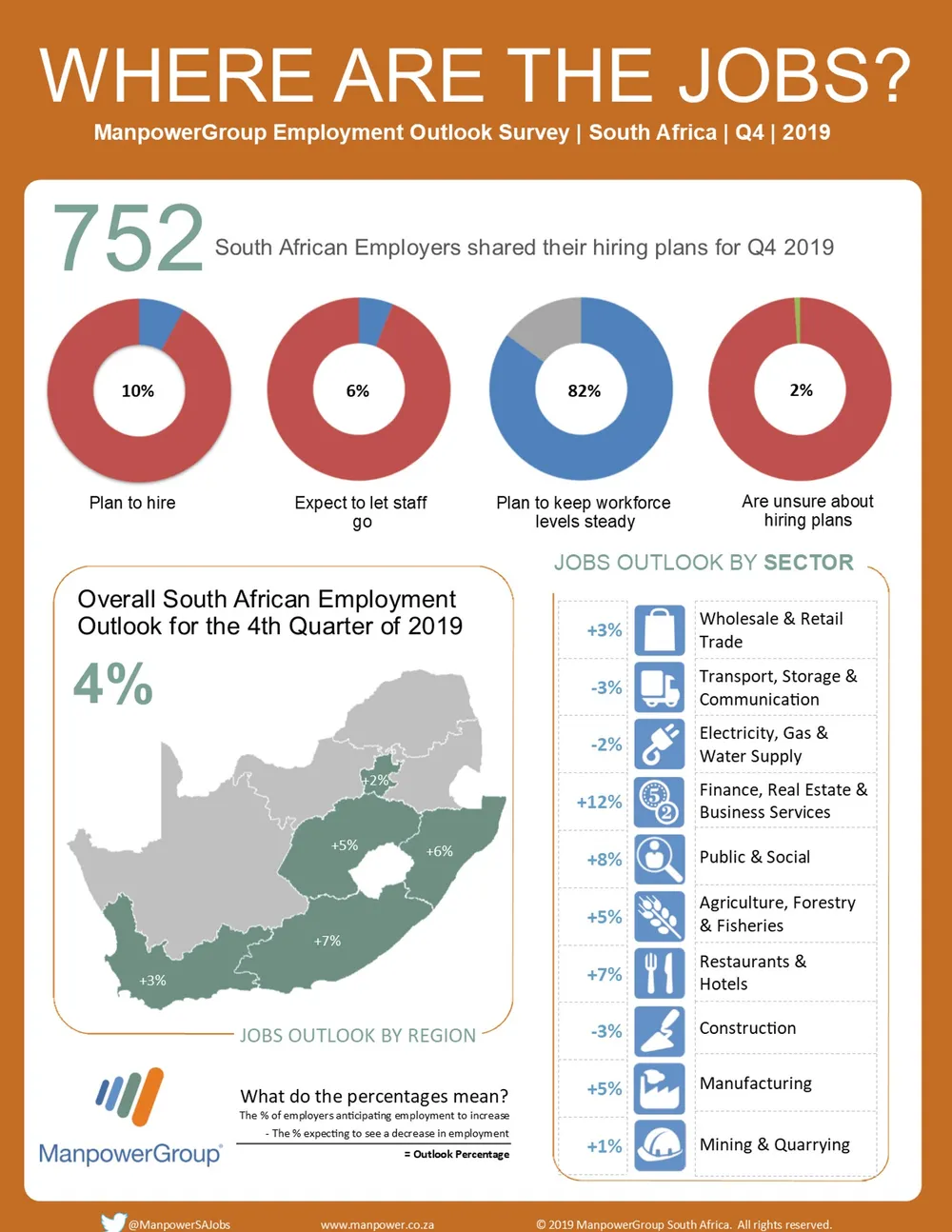

DURBAN – According to the latest ManpowerGroup Employment Outlook Survey, South African employers report soft hiring intentions for the last quarter of the year.

While 10 percent of employers anticipate an increase in payrolls, 6 percent expect a decrease and 82 percent forecast no change. Once the data is adjusted to allow for seasonal variation, the outlook stands at +4 percent. Hiring prospects are unchanged when compared with the previous quarter but decline by 2 percentage points in comparison with this time one year ago.

"As we move into the last quarter of 2019, South Africa’s economy continues to be weighed down by factors such as slow economic growth, policy uncertainty and a high unemployment rate. This can translate into businesses exercising caution around hiring and spending-related activity, which is reflected in 82 percent of responding companies expecting to make no change in their hiring strategies during the October to December timeframe," said Lyndy van den Barselaar, the managing director of ManpowerGroup SA.

Regional Comparisons

Employers expect to add to payrolls in all five regions during the upcoming quarter. Eastern Cape employers forecast the strongest labour market, reporting a net employment outlook of +7 percent, while outlooks of +6 percent and +5 percent are reported in KwaZulu-Natal and Free State, respectively. Elsewhere, employers expect limited job gains, reporting outlooks of +3 percent in Western Cape and +2 percent in Gauteng.

"There are currently initiatives taking place in the Eastern Cape that are focused on development of the region and that are well placed to create employment," said van den Barselaar.

Moderately stronger hiring intentions are reported for Eastern Cape and Free State when compared with the previous quarter, with outlooks improving by 7 and 6 percentage points, respectively. However, Gauteng employers report a decline of 4 percentage points and the Western Cape Outlook is 3 percentage points weaker.

In comparison with the final quarter of 2018, hiring prospects weaken in three of the five regions. Decreases of 7 percentage points are reported in both Gauteng and KwaZulu-Natal, while the Western Cape outlook declines by 6 percentage points. However, Eastern Cape employers report a considerable improvement of 14 percentage points and the Free State Outlook is 6 percentage points stronger.

Sector Comparisons

Employers expect workforce gains in seven of the 10 industry sectors during the final quarter of 2019. Finance, insurance, real estate & business services sector employers expect the strongest hiring pace, reporting a net employment outlook of +12 percent. Elsewhere, moderate job gains are forecast in the public & social sector and the restaurants & hotels sector, with outlooks of +8 percent and +7 percent, respectively.

Outlooks of +5 percent are reported in both the agriculture, hunting, forestry & fishing sector and the manufacturing sector.

Hiring intentions weaken in five of the 10 industry sectors when compared with the previous quarter. Transport, storage & communications sector employers report the most noteworthy decline of 7 percentage points, while outlooks decrease by 4 and 3 percentage points in the electricity, gas & water sector and the mining & quarrying sector, respectively. Meanwhile, outlooks improve in four sectors, most notably by 5 percentage points in the construction sector.

In a comparison with the final quarter of 2018, hiring prospects strengthen in five of the 10 industry sectors, including the finance, insurance, real estate & business services sector with an increase of 6 percentage points. Elsewhere, outlooks are 4 percentage points stronger in both the manufacturing sector and the public & social sector.

However, hiring plans also weaken in five sectors. Employers in both the transport, storage & communications sector and the wholesale & retail trade sector report considerable declines of 14 percentage points, while the agriculture, hunting, forestry & fishing sector outlook is 12 percentage points weaker.

Content supplied by ManpowerGroup.