This South African businessman lost R5.6 billion thanks to Trump's tariff tirade

While some have benefitted, a South African businessman's finances has taken a major hit thanks to US President Donald Trump's implementation of tariffs.

Image: Se-Anne Rall/IOL

Along with the millions of people around the world, former De Beers chairman Nicky Oppenheimer has lost billions of dollars in a year that markets slumped following US President Donald Trump’s imposition of massive tariffs earlier this month.

Oppenheimer, who is the world’s 241st richest man according to Bloomberg’s Billionaire Index, has seen his wealth drop $300 million this year as of Wednesday morning. While that’s only a decline of 2.6%, it translates into R5.6 billion.

This is almost 0.75% of South Africa’s gross domestic product. South Africa's total National Budget for the 2025/26 financial year is R2.59 trillion, while the value of the economy is R7.5 trillion.

As of the middle of April, Oppenheimer had “only” lost $150m – R2.8bn at Wednesday’s exchange rate of R18.53 to the greenback.

His current worth is $11.2 billion, or R207bn.

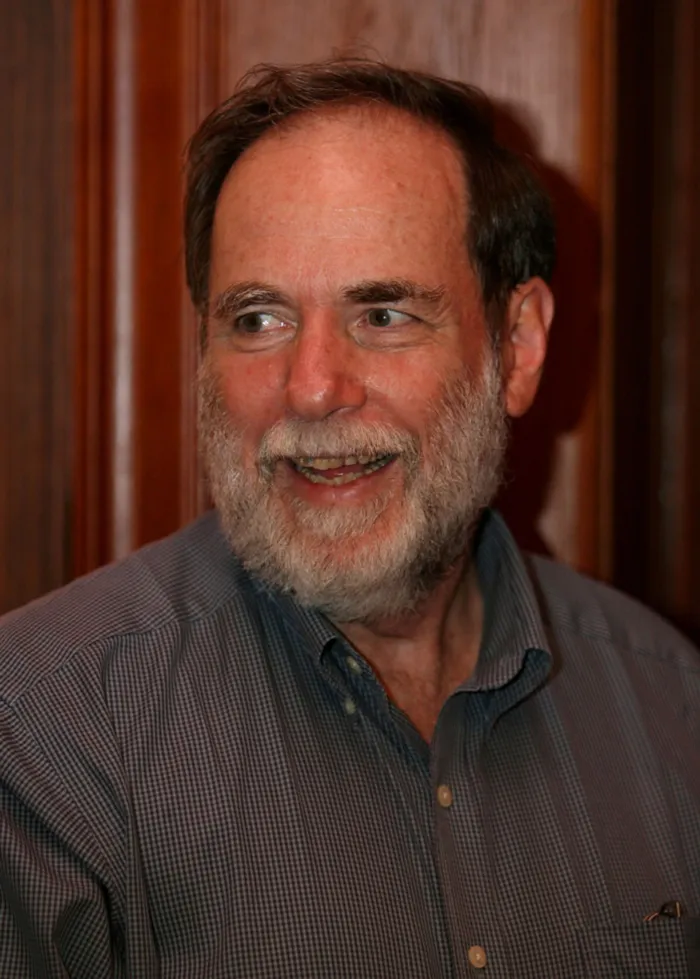

Former De Beers chairman Nicky Oppenheimer has lost billions of dollars in a year that markets slumped following US President Donald Trump’s imposition of massive tariffs earlier this month.

Image: Dumisani Sibeko

Oppenheimer, according to Bloomberg’s research, earned $5.2bn in cash in 2012 when he sold his family's 40% stake in De Beers to Anglo American. His investments are located around the globe and include those in South Africa, Asia, America and Europe.

The S&P500, a major US stock index, has declined 5.79% year-to-date following steep losses triggered shortly after April began, when former U.S. President Donald Trump declared significant tariffs on imported goods.

Similarly, the Nasdaq – tech-heavy exchange – has fallen nearly 10% since the start of the year, with its sharpest downturn also occurring after Trump’s April 2 “Liberation Day” tariff announcement.

In the aftermath of market backlash, Trump later partially reversed course, delaying tariffs for most countries for 90 days and dropping these down to the 10% he had, at one stage, indicated would be imposed.

China, however, faced far steeper penalties: tariffs of up to 145% tied to the “Liberation Day” declaration, which mean that Americans purchasing Chinese items would pay as much as 245% more.

Though Trump recently indicated he was open to negotiations with China, the financial fallout remains has already happened with billions erased in investors’ market value and many economists anticipating the country will go into a recession.

IOL

Related Topics: