The Consumer Price Index rose to 2.8% in April, up from March's 2.7%, contrary to some economists' expectations of a decrease.

Image: Henk Kruger/African News Agency (ANA)

The Consumer Price Index (CPI) rose to 2.8% in April, up from March's 2.7%, contrary to some economists' expectations of a decrease. Despite this, there is still hope that interest rates may come down at the end of this month by 0.25 percentage points.

The current prime lending rate is 11%.

Old Mutual chief economist, Johann Els, noted that the number was “a touch higher than expected” as the consensus seemed to be for 2.7%, although he expected that the rate of growth in the cost of living could slow to 2.6% or as little as 2.5%. He explained that the 2.8% figure is “still below the bottom end of the 3% to 6% target range”.

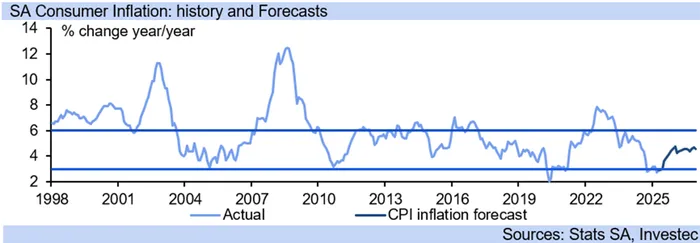

Inflation history and forecasts

Image: Stats SA/Investec

Els, who expects an interest rate cut towards the end of the month, pointed out that the rand is stronger than 18 to the dollar, having dropped as low as R17.89 on Wednesday morning. He added that oil prices are lower, with Brent crude currently at $66.26 a barrel, and more petrol price cuts are coming.

“Global risks have eased quite substantially between the previous Monetary Policy Committee (MPC) meeting and the one coming up. So, rates should be cut by 25 basis points next week,” Els said.

“I still think that under these circumstances; the South African Reserve Bank (SARB) should cut rates next week at the next scheduled MPC meeting. It is a close call,” said Els, adding that there is likely to be a split vote.

Concurring, Casey Sprake, economist at Anchor Capital, told IOL that the latest inflation data strengthens the case for monetary easing. “We expect SARB to cut the repo rate by 25 basis points at its upcoming MPC meeting on May 29,” she added.

SARB Governor Lesetja Kganyago holds the deciding vote when the committee, comprised of five members, takes their ballot.

A third rate cut later in 2025 is possible, depending on domestic and international factors such as commodity prices, currency movements, and geopolitical risks, said Sprake.

Disagreeing is Investec chief economist, Annabel Bishop, who said: “We expect that the Reserve Bank will leave interest rates unchanged at its meeting this month, as it remains concerned over the high degree of uncertainty in the global outlook.”

However, she noted that much will depend on whether new inflation targets are announced in the National Budget later today, with National Treasury setting the inflation targets and SARB responsible for achieving them.

Kganyago has suggested reducing the target band, contingent upon National Treasury implementing necessary policies.

Sprake said that the inflation rate “suggests a continued softening of underlying inflationary pressures within the domestic economy, reflecting a broader trend of subdued pricing momentum across non-volatile goods and services”.

Examining the numbers, Els said that consumer goods inflation remains very low. “In fact, surprising to the downside. For instance, vehicle prices declined in the month of April from March and vehicle inflation is now just 2.1% on a year-on-year basis.

“If we look at why inflation came out a touch higher than expected, alcoholic beverages rose more than expected between March and April and data and information services was higher than expected. Mobile data, for instance, rose by 3.1% month-on-month,” said Els.

Sprake noted that inflation for food and non-alcoholic beverages accelerated to 4.0%, the highest rate since September 2024 (4.6%). Monthly prices rose by 1.3%, driven mainly by higher meat prices like stewing beef, mince, and steak. Meat prices increased by 2.3% between March and April, marking the largest gain since January 2023. As meat makes up 5.1% of household spending, these increases impact consumers significantly, especially lower-income households.

Els explained that internet costs rose by 2.1% month-on-month, satellite TV subscriptions rose by 4.2% month-on-month and subscription to other streaming services by 1.8% month-on-month. “These are irregular surveys, so just capturing the latest annual increases in mobile data and subscription services for TV. So those were higher than expected.”

Sprake noted that lower fuel prices were benefiting the inflationary figure as, on average, fuel prices dropped by 3.2% between March and April. Compared to a year ago, motorists are now paying 13.4% less for fuel, she said.

Els said that inflation remains “well under control”.

The headline number for the next few months is expected to remain below bottom end of the target range, mostly around 2.5% to 2.7%, before gradually drifting up, said Els.

IOL

Related Topics: