U-Turn on VAT hike is good news for inflation, but revised Budget will still hurt the poor

The scrapping of the VAT increase is good news, but government still has a revenue hole to fill.

Image: Ayanda Ndamane / Independent Newspapers

Inflation will no longer be hit by a proposed hike in Value Added Tax (VAT) given that, just days before it was set to increase from 15% to 15.5%, National Treasury issued a statement saying that the Minister of Finance, Enoch Godongwana, will maintain the tax rate at the current level.

Investec senior economist Annabel Bishop had previously calculated that the increase of 0.5 percentage points in 2025 and again in 2026 would add 25 basis points in terms of inflation to each year.

In March, the rate of inflation dropped from 3.2%, the month before, to 2.7%. Initially, the February budget proposed an increase from 15% to 17%.

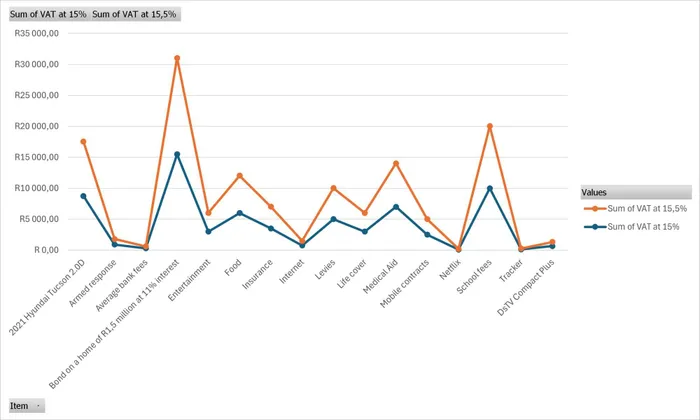

Effect of VAT change on general basket.

Image: Nicola Mawson

However, government still has a revenue hole to fill, given that by not increasing VAT, estimated revenue will fall short by around R75 billion over the medium-term, National Treasury’s statement said.

Instead, Godongwana will now seek alternative measures to cover this shortfall in revenue.

“Parliament will be requested to adjust expenditure in a manner that ensures that the loss of revenue does not harm South Africa’s fiscal sustainability,” the statement said.

The proposed VAT hike of 0.5 percentage points was due to come into effect on May 1.

Earlier this week, the Democratic Alliance (DA) and Economic Freedom Fighters (EFF) took Godongwana and several other institutions, including the South African Revenue Service, to court to halt implementation. That ruling was expected to be handed down on April 29.

The DA on Tuesday, during a press conference, argued that the Minister was imposing a fiscal framework enabling voting on the National Budget containing the VAT increase without agreement between all parties. It wants the fiscal framework containing the VAT increase overturned.

In their filing, the DA and EFF argued that the adoption of this fiscal framework was “unlawful”.

This fiscal framework has caused confusion regarding the VAT increase as ActionSA has claimed to have halted the framework, and thus the Budget’s, implementation with National Treasury having 30 days from April 1 to come up with alternative proposals.

National Treasury said in its statement issued on Thursday morning that the Minister will shortly introduce the Rates and Monetary Amounts and the Amendment of Revenue Laws Bill, which proposes to maintain the tax at its current level.

“The decision to forgo the increase follows extensive consultations with political parties, and careful consideration of the recommendations of the parliamentary committees."

However, the Minister’s reversal means that other measures to cushion the poor against the proposed hike will have to be reversed. The latest National Budget, eventually tabled in March after it failed to be passed in February, proposed increasing the basket of zero-rated, or VAT-exempt, items to aid lower income households.

The Minister of Finance expects to introduce a revised version of the Appropriation Bill and Division of Revenue Bills within the next few weeks, in which it will propose that VAT will remain the same.

National Treasury stated that the initial proposal for an increase to the VAT rate was “motivated by the urgent need to restore and replenish the funding of critical frontline services that had suffered reductions necessitated by the country’s constrained fiscal position”.

The statement said the department would consider all potential proposals to increase revenue collection.

Get your news on the go, click here to join the IOL News WhatsApp channel

IOL Business

Related Topics: