Why South African traders are switching brokers – Octa survey reveals key red flags

A recent global survey by international broker Octa revealed that trust-related concerns — including withdrawal issues, chart manipulation, and hidden fees — are among the top reasons why South African traders switch brokers

Image: Supplied

In South Africa’s fast-growing trading community, trust has become a dealbreaker. A recent global survey by international broker Octa revealed that trust-related concerns — including withdrawal issues, chart manipulation, and hidden fees — are among the top reasons why South African traders switch brokers.

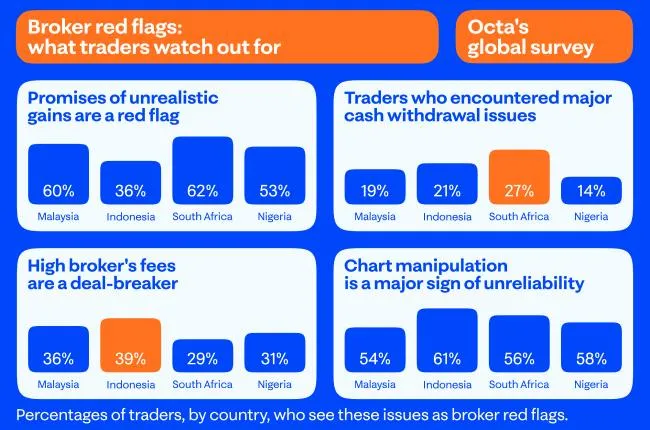

As a trusted broker focusing on building long-term, mutually beneficial client relations, Octa regularly researches traders' behaviours. The study, which gathered responses from over 2,000 traders across South Africa, Indonesia, Malaysia, and Nigeria, found that issues like hidden fees, poor withdrawal processes, and aggressive sales tactics are pushing traders to find more transparent platforms.

"For South African traders, transparency and consistency aren’t just nice-to-haves – they’re non-negotiables," says MJ Givens Kgasi, an analyst at Octa. "The number of brokers available today is overwhelming, but traders are learning quickly how to spot red flags. Once trust is broken, they move on."

Among South African respondents, some of the most common red flags include promises of unrealistic gains (62%), major cash withdrawal issues (27%), and chart manipulation (56%). These experiences often lead to frustration and financial loss – particularly for newer traders still learning the ropes.

Global survey by international broker Octa

Image: Supplied

Being in the know

As a regulated and trusted broker, Octa works with independent, third-party liquidity providers to offer its clients non-distorted market prices. Octa also provides access to historical chart data so that traders can verify that the broker’s prices align with actual market conditions and that there were no chart manipulations or price slippages at any given time.

Traders also flagged excessive fees (29%) and platforms that demand too much personal data upfront or bombard users with pushy marketing tactics. "If a broker is more focused on upselling than educating, that’s a major warning sign," adds Kgasi. "We found that South African traders value brokers who support their growth rather than pressure them into risky decisions."

Good broker signs

So, what do South African traders want instead? According to the survey, local traders place high value on low trading costs, fast and reliable withdrawal systems, responsive support, and clear regulatory frameworks. These priorities reflect a growing maturity among South Africa’s trading community – one that expects brokers to operate with integrity and put clients first.

Octa, which has been active in the trading space since 2011, recommends testing a broker first-hand and forming your own opinion instead of mindlessly believing optimistic promises. Among other advantages, the broker offers a fast and efficient withdrawal procedure that can easily be tested by any trader who engages with Octa, regardless of the country.

"The feedback confirms what we’ve always believed: trust isn’t built through slogans – it’s built through consistency," says Kgasi. "Whether it’s delivering on withdrawals, offering accessible support, or keeping trading conditions clear and fair, trust is something you prove every day."

Octa’s global reach gives it a wide lens into the concerns of traders across markets, but the broker says South Africa is one of the most engaged and discerning audiences it serves. As more South Africans explore forex and crypto trading, the need for responsible brokers that value trust will only grow.

"South African traders are savvy. They want to learn, grow, and trade with confidence," concludes Kgasi. "Our job is to create an environment where that’s possible – and where trust isn’t just a feature, but a foundation."

Related Topics: